Risks of Free Online Templates

Can small business owners trust free online legal templates? This article explores the risks and the advantage of working with experienced Legal Counsel.

Can small business owners trust free online legal templates? This article explores the risks and the advantage of working with experienced Legal Counsel.

Third party platforms help Canadian companies move faster, but they also shift privacy, security, and compliance obligations onto the customer. This guide explains the most common mistakes businesses make and how to avoid hidden risks before signing on with a platform.

If your corporation still owes a CEBA loan and has no assets or activity, you may be wondering whether you can legally dissolve the company. This practical guide explains exactly what Canadian business owners can do when a CEBA loan is still on the books, the steps required to wind down a corporation, and how to protect yourself from director liability during the process.

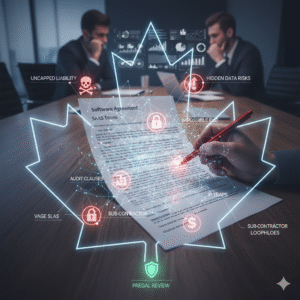

Canadian founders often sign SaaS agreements without realizing they are accepting major financial and operational risks. This guide breaks down the most common red flags in software and cloud contracts and explains how a technology lawyer protects your company before you sign.

Liability caps and indemnities often become the most expensive parts of a technology agreement. This guide shows Canadian businesses how to negotiate balanced financial protections and avoid unexpected exposure when signing software or service contracts.

Canadian companies often work with customers or vendors in the United States or Europe without realizing that cross border data sharing creates real privacy obligations. This guide explains how Canadian businesses can stay compliant with PIPEDA and international privacy rules while scaling internationally.

Many Canadian companies sign US drafted terms without realizing they are accepting rules that do not match Canadian law or their own risk tolerance. This guide explains how to evaluate US terms, spot hidden legal and financial exposure, and negotiate fair protections before you click accept.

Canadian companies often assume they own the code or designs produced by contractors. That assumption is wrong unless the contract states it clearly. This guide explains how to structure contractor relationships so your company retains full ownership of its intellectual property.

Understanding Corporate Annual Returns in Canada Annual returns are mandatory filings that maintain your corporation’s legal status, separate from tax obligations. Both federal (CBCA) and

At Onley Law, we’re entrepreneurs like you, specializing in Business Law to address your unique challenges and get business done.

Contact us for a free, no-obligation consultation, and let’s navigate the legal landscape together, empowering your business to thrive.

With our office located in downtown Oshawa, we work in the heart of one of Ontario’s most historic, hardworking cities – powered by builders and doers.

Operating inside the Spark Centre, we operate and work alongside entrepreneurs inside Durham’s top business accelerator.

Find us at: 2 Simcoe Street South, Suite 300, Oshawa, Ontario, L1H 8C1.